What are the best financial tips for college students?

How do you survive college financially?

September is right around the corner, which means that many college students are preparing to return to campus for the fall semester. As many students know, money can be tight during college.

There are a lot of expenses to keep up with, such as textbooks and food, among many other things, which can place a financial strain on your life as a student.

Between classes and extracurricular activities, many students are extremely busy, leaving little time for a part-time job to earn some extra income.

However, with clever financial maneuvering and some self-control, college students can manage their money effectively throughout the semester.

These four financial tips for college students will help you manage your money more wisely and even save more money this academic year.

THIS POST MAY CONTAIN AFFILIATE LINKS.

IF YOU MAKE A PURCHASE FROM THESE LINKS, I MAY EARN A SMALL COMMISSION.

CLICK HERE FOR MY FULL DISCLAIMER STATEMENT.

4 Money Savng Tips for College Students

Here are some financial tips for students to help you find success throughout their time in college:

#1. Living College Life on a Budget

With many variable costs throughout your time as a college student, it’s imperative that you learn how to properly budget your money. This can be difficult as a student because you’ll have to balance weekly expenses with one-time purchases throughout the semester.

The first step when budgeting is to determine how much money you have at your disposal, and then from there you can break it down by spending categories.

In an ideal situation, you’ve had a job over the summer and have been able to amass some savings. If you don’t plan on having a part-time or work-study job during the semester, you need to make this money last.

👉🏽 RELATED POST: Best Side-Hustles for College Students

If you do plan on having a job, try to calculate how much you will earn over the course of the semester and add it to the additional money that you have set aside from your savings.

This is the total money pool you’ll be able to access throughout the semester.

College Student Budget Formula

Here is an example:

Savings + (Weekly income * number of pay days) = Total budget for the semester

$2000 + ($200 * 15) = $5000

Once you’ve determined your total budget for the semester, you need to break down your finances between one-time and recurring costs.

Examples of one-time costs include furniture for your living space, transportation to and from school, annual club fees or dues, school supplies/equipment, and textbooks which you’ll purchase at the beginning of the semester.

👉🏽 RELATED POST: How to Budget with Sinking Funds

Some of these costs can really add up, so it’s important to estimate as accurately as possible—textbooks alone can cost you more than $600 per semester. Begin by trying your best to calculate all of these costs and then come up with a grand total. Then subtract that from your total budget for the semester.

| Furniture | $300 |

| Transportation | $400 |

| Club Dues | $200 |

| School Supplies | $100 |

| Textbooks | $600 |

| Total | $1,600 |

*Note: all of these costs are hypothetical. Your budget may vary.*

Now that you’ve determined your total budget, and then subtracted all of your planned one-time expenses, you can calculate your weekly allowance for recurring costs.

In the above example, you’d have $3400 left for weekly expenses. Divide this total by the number of weeks that you’ll be on campus.

$3400 / 17 weeks = $200 per week

As a college student, common recurring expenses include food, cleaning supplies and toiletries, and rent, if you’re living in off-campus housing. By breaking down these expenses into the same weekly timeframe, you can more easily keep track of how much you can spend.

Hopefully, you will have planned everything out to the best of your ability, and you’ll be able to afford these costs with the remainder of your budget.

One important thing to keep in mind as a college student is that you may come across additional unplanned expenses. These surprise or emergency costs can place a lot of financial burden on an already strained budget, so if you have extra wiggle room, try to set aside additional funds every week into an emergency fund just in case you need extra cash.

👉🏽 RELATED POST: Smart Goals for College Students

#2. Saving Money on Student Essentials

As a college student with tight finances, you’ll want to save money wherever you can.

Luckily, there are plenty of ways to save money on all of the essentials you need as a student. Even if it’s just a few dollars here or there, every chance to save money can add up.

Here is a list of common expenses and saving tips for each:

A. Buy Used Textbooks

These are undoubtedly some of the most expensive necessities for college students. Luckily, there’s a couple of different ways that you can save.

First, you should always look to buy or rent used textbooks online. If you’re only using the book for the semester, there’s no need to buy a new copy from the campus bookstore, where it’s bound to be more expensive.

You may also consider waiting until after the first day of classes before you buy—sometimes professors will have books listed on the syllabus, but only plan on using them sparingly and won’t require you to buy them.

Another option is to split the cost with a friend. This should only be done with somebody you completely trust, but taking classes with a friend and sharing the book can save you a lot of money. Finally, if you chose to buy rather than rent, get some money back at the end of the semester by reselling your used books.

👉🏽 RELATED POST: 15 Ways to Cut Spending

B. Don’t Buy New Furniture

Don’t buy new furniture for your dorm or apartment if you don’t need to. You’ll only need it for a short period of time, and the college years can put a lot of wear and tear on your furniture.

Whether you need a desk, chairs, shelving, or just some odds-and-ends, there are plenty of places to find used furniture for cheap. Try looking in thrift stores or websites that specialize in used furniture.

If you do need to buy new furniture, some stores offer special financing plans that allow you to pay in monthly installments, rather than having to pay everything upfront.

C. Use Discounts on Food Items

Spending money on food is essential, but what’s not essential is spending beyond your means. There are plenty of different ways to save, depending on your shopping habits.

First, take some time to coupon and see what foods are on sale that week. Nowadays, there are even apps that can help with the process—some help you do price comparisons between stores, while others offer rebates on certain products.

Another way to save money is by meal planning for the week. Not only will you spend less money on ordering food for delivery, but you will also have a game plan going into your trip to the grocery store, leaving you less likely to waste money on random food that you’ll end up throwing away.

D. Claim Student Discounts

whether you’re shopping for groceries at a local store, or looking for clothes from a national chain, many types of stores offer discounts for college students.

In most cases, discounts can range between 10 to 15 percent, which may not seem like a lot, but can really add up over time. If stores offer a senior citizen or military discount, chances are they may have one for students too.

Wherever you go shopping, make sure that you’re carrying your student ID, and don’t be afraid to ask! You’d be surprised how often you can find a student discount.

And of course, if you’re shopping online, get Rakuten, which offers anywhere from 2% and up at major retailers. Click here to claim $10 free dollars when you make your first purchase.

This is why, budgeting is the number one money-saving financial tip for college students.

#3. Managing Finances as a College Student

It can be difficult to manage your finances as a college student, especially with a tight budget and various expenses. But if you want to make smart decisions and stay on top of your budget, you’ll have to be able to properly track and monitor your personal finances.

If you’re a student with a busy class schedule, and little access to transportation off-campus, it may be difficult for you to get to a bank. If this is the case, you may consider choosing a service that offers an app for digital banking.

Rather than taking time out of your busy life as a college student to manage your finances, you can do everything from your smartphone. Monitoring transactions with instant notifications, checking your daily balance, avoiding hidden fees, and utilizing unique features like automatic savings are all possible with an online banking app.

Not only do you need to be able to manage your finances, but you also need to track the progress of your budget on a weekly basis.

👉🏽 RELATED POST: Smart Financial Goals for College Students

Sure, you’re heading into college with a plan with how much you have at your disposal, but your expenses may unexpectedly change on a weekly basis.

If you have outlined $200 worth of spending on a weekly basis, but end up spending $250 one week, you need to be able to adjust your spending and cut back in the upcoming weeks. And vice versa, if you’ve gone under budget, you can make other adjustments as you see fit.

One way to easily track your spending is with the help of expense management tools. Make sure to keep in mind what you’re spending on each financial category that you have predetermined—you may discover that your previous estimations were wrong.

#4. Surviving the Semester Financially

There may come a time during the semester in which you are struggling financially, more so than usual.

It’s during these trying times that you need to be prepared to make tough financial decisions in order to make it through the semester. College is definitely meant to be a time for learning, as well as some fun, new experiences—but that means that you need to adjust your priorities when things get difficult.

If your bank account is nearly empty and you’re waiting on your next paycheck from a work-study job, you should only be spending money on the essentials. Every situation is different, but you may need to stop spending money on “wants” like streaming services, dining out, and alcohol.

👉🏽 RELATED POST: Mental Health Tips for College Students

Did you know—college students spend roughly $5.5 billion every year on alcohol?

That total equates to several hundreds of dollars per student. It’s not ideal to have to cut back on your budget, but sometimes you need to make difficult financial choices as a college student.

Final Tip for Finances in College

The college years can be full of uncertainties, especially now more than ever. Adding to the unknown is a lack of control over your personal finances, which can leave you stressed and worried.

However, with the proper planning, informed decision making, and the right financial tips, you can set yourself up for success as a college student.

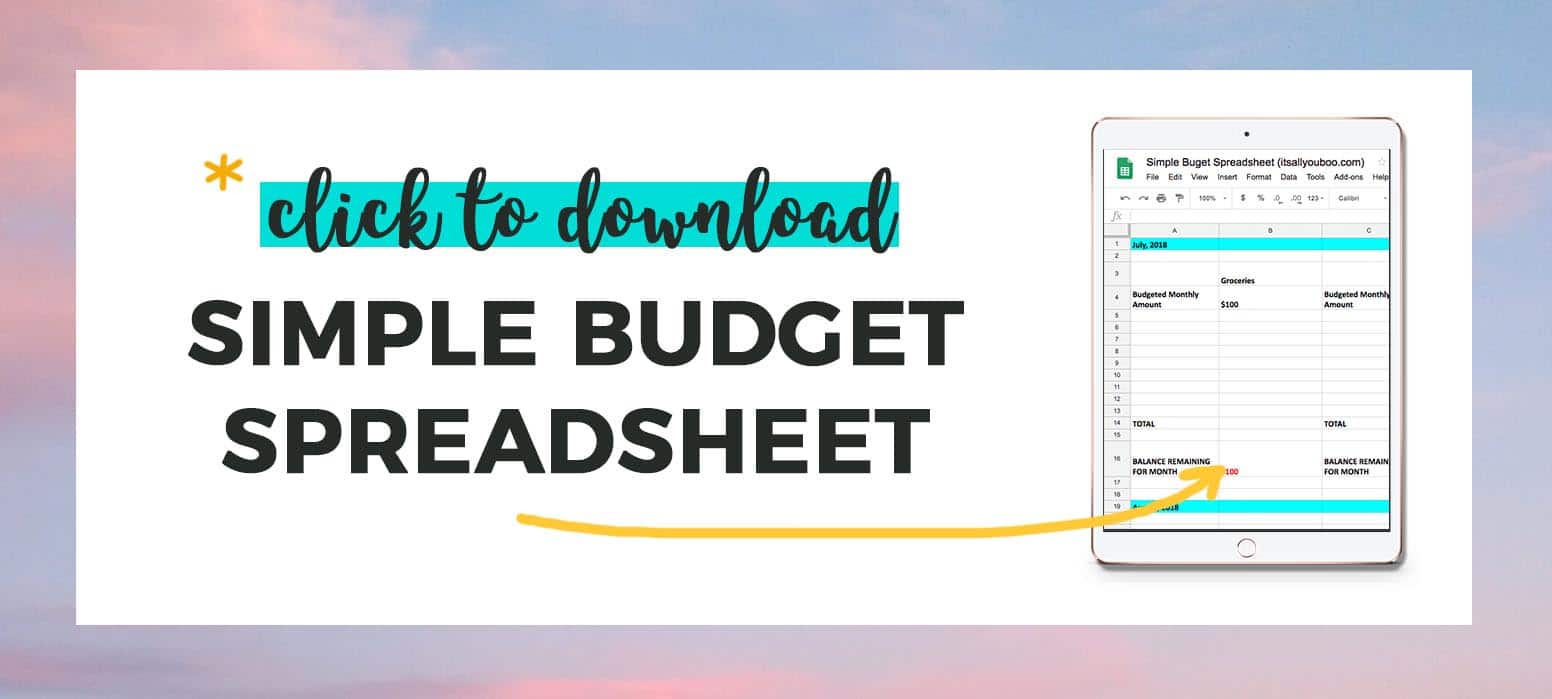

Get Your Simple Budget Spreadsheet

Ready to create your budget for college? Great, get the Simple Budget Spreadsheet, compatible with Google Docs and Microsoft Excel.

Don’t wait until the end of the year, start preparing your finances for college today. How else will you enjoy the holidays, buy that new computer or phone, or even take the summer off?

It all starts today with these money-saving tips for college students.

Struggling with expenses in college? Need to make ends meet? Click here for 4 financial tips for college students to help you budget, save money, and survive college financially. #StudentLife #Finances

What financial tips for college students will you follow?

Last Updated on July 23, 2024